The US property market saw properties almost flying off the shelves last year according to new research from an online property portal . In 2017, homes took just 81 days to closure making it the fastest year for sales on record.

Strong demand and lack of available building land means that despite the rise in permits there are just not enough new single-family homes in the US.

A recent survey shows rentals are a more popular option on the US property market with everyone including Baby Boomers, once staunch homeowners.

In the year to February, US new home permits and sales went up, but not enough to keep up with pent-up demand in a challenging buyer’s market.

An annual review of the best places to buy a US holiday let contains some surprises and some givens and Florida continues to tick all the boxes.

One quarter of the best US cities for jobs are Florida metros. Read which are top for job and wage growth and by extension property investment.

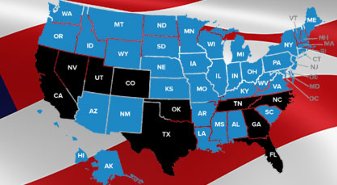

The US housing market will have a good 2018 but some states will do better than others. Discover the top 10 for US property investment this year

A recent study of millennials in the US finds they’re moving south and west. Florida metros feature in three of their top ten favoured locations.

After a year of surprises in 2017 when few predictions came true, Forbes expect the following five trends for the US property market in 2018.

Despite the rise in US residential construction in 2017, supply still lags behind demand. Read why 2018 will be a good year for new homes.

Discover the trends expected dominate the US property market in 2018 when supply will continue to drop and prices continue to rise.

Prices have been rising steadily but is there a real risk of a US property market bubble? The answer turns out to be a resounding no.

US foreclosure properties, once a huge market burden, now stand at their lowest rate for over 11 years. Many metros have rates last seen in 2005

2017 has undoubtedly been an excellent year for the US property market. With under three months to go, predictions are already coming in for 2018. Freddie Mac’s latest economic outlook makes good reading for US investors as it points to more of the same.

It’s the question on every property investor’s lips. And the latest Market Hotness Index from Realtor.com provides the answer. The listing for August shows continued heating up of the US property market and includes some surprises.

Latest figures for homeownership in the US point to a slight increase in the rate in Q2 this year. More millennials bought homes between April and June, pushing the homeownership rate up in this group. Traditionally the strongest sector in the US rental market, they are about to be joined by Generation Z, a whole new target for rental properties.