The latest nationwide report on the best single family home investment in the US reveals that returns in 2020 have dropped very slightly compared to 2019. Key countries continue to be those in the Baltimore and Atlanta metro areas while Florida counties provide returns in the region of 8 to 12%.

Slightly lower returns nationally

According to the ATTOM Data Solutions annual report for the first quarter of this year, returns for single family home investment in the US have fallen slightly. In Q1, they stood at an average of 8.4% a year across the country, down from 8.6% a year ago.

The report attributes the small drop to the difference between the speed at which rental rates and house prices are rising. During 2019, rents for single family homes started increasing at a slower rate while house prices continued to rise sharply.

However, as Todd Teta, chief product officer at ATTOM Data Solutions, points out, investment options remain solid. “From the national perspective, things are generally holding steady for landlords in the single-family home rental market”, he said.

Highest returns for single family home investment in the US

The top three counties offering the highest annual returns in Q1 2020 were identical to those for 2019. At the top of the rankings stood Baltimore County where investors in single family home properties can expect yields of 28.9%. In second place was Cumberland County with 20.1%, followed by Clayton County where investment properties have returns of 15.1%.

The report also looked at those counties set to see the highest increases over the next year. The biggest rise in yields will come from single family home rentals in Saint Clair county with an uptick of 21%. Jefferson and Mobile counties rank a close second and third with an expected rise of 20.7% and 19.6% respectively.

At the other end of the spectrum are the counties offering with worse yields for single family home investment in the US. Californian counties dominate these rankings and the lowest returns are in San Francisco and San Mateo counties. Here, investors can expect just 3.8% annual return from their buy-to-let properties.

Florida counties offer above average returns

The report provides detailed yield information for each of the 380 counties it covers. Florida counties generally fall within the 8 to 12% return bracket although several outperforming the US average.

Particular hotspots for single family home investment in Florida include the best performers of all, Hernando and Pasco. In Q1 this year, these counties offered yields of 11.8% and 11.6% respectively, well ahead of the national average. Both lie within the Tampa-St Petersburg-Clearwater metro area, a highly sought-after relocation and employment spot in Florida.

If you’re considering Florida for single family home investment in the US, other counties worth looking at include Duval near Jacksonville. Here, investors can expect an average annual return of 9.5% according to ATTOM Data Solutions. Osceola county (part of the Orlando metro area) also offers a higher than average 8.8%.

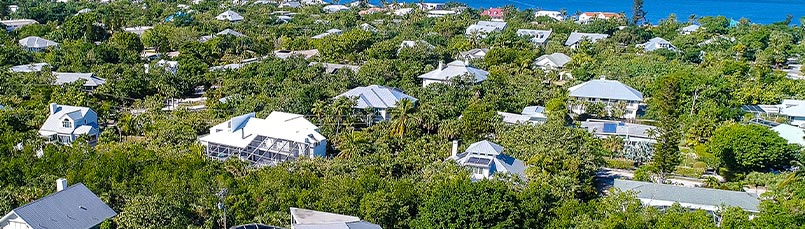

Single family home investment in Florida

The Sunshine State ranks as the second fastest growing state in the US in terms of population growth. It receives around 900 new residents a day, an increase that translates to strong demand for housing. Single family homes are popular options, particularly in employment hotspots.

BRIC Group offers investors a choice of buy-to-let properties in Florida, many of which come with guaranteed rental returns. All are in sought-after locations, ensuring consistent demand for rentals and high yields.

(Source: ATTOM Data Solutions)