The Brazilian property market continues to register excellent results in 2020 as buyers flock to purchase homes. In Northeast Brazil in October, mortgage loans in Ceará posted their highest volume in five years. Lending in the state went up by almost 33% in the year.

Highest volume since 2015

Despite the pandemic and lockdown, the property market in Ceará is experiencing one of its busiest years. Since March, mortgage loans in Ceará have posted big increases every month.

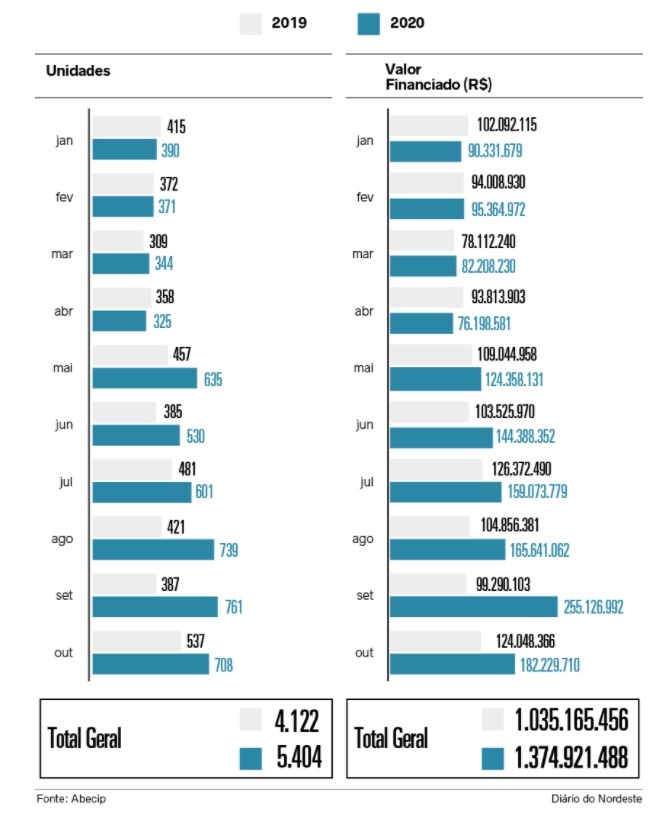

The latest figures from the Brazilian Mortgage Association (ABECIP) show an increase of almost 33% between January and October. Mortgage lending in Ceará went up by 32.82% compared to the same period in 2019. The volume reached R$1.374 billion, the highest since 2015.

Even during a pandemic

Mortgage loans in Ceará have seen an exponential rise this year compared to last. As the graphic below clearly illustrates, lending has increased every month. With the exception of January and April, 2020 has been a year of more loans.

Even during lockdown (May), the number of approved loans went up by 38.9% compared to the same month in 2019. As Ceará came out of lockdown in June, mortgage loans increased by 37.7%. And since then, the numbers have grown even higher.

Busy season for mortgage loans in Ceará

September was an exceptional month for lending in the state and October also saw an increase of almost 32% in new loans. Spring is traditionally one of the busiest times for the Brazilian property market, but 2020 is proving to be especially frenetic.

Between January and October this year, banks approved mortgages for 5,404 properties in Ceará. This translates to a 31.1% increase on the same period in 2019 when loans were used for 4,122 units.

Surprise in the sector

The construction and development sectors have received the figures with enthusiasm. “The news is super positive and better than we expected,” said Patriolino Dias, President of the Ceará Civil Construction Union (Sinduscon-CE).

“People are rushing to buy property because of low interest rates,” he added. “Buyers are getting funds out from other investments to buy a home, which in turn, boosts our sector.”

More of the same in 2021

Analysts believe that the property market in Ceará can expect more rises in mortgage lending for the rest of the year. And they predict similar levels of activity in 2020 based on the lowest interest rates ever in Brazil.

The Brazilian Central Bank has plans to raise the Selic interest rate in 2021 (from 2% to 2.75%) with a further rise to 4% in 2022. However, as Ricardo Eleuterio of the Ceará Regional Economic Board (Corecon) points out, this is unlikely to put buyers off.

“The stock market is an option, but it can fall,” he said. “The property market appeals even when interest rates are at 6% because they will still be low.”

Take advantage of the market

The rise in mortgage lending in Ceará reflects the positivity in the Brazilian property market as a whole. In early November, the economic broadsheet Exame described it as “the best moment for years”.

Rental returns in Brazil are now higher than return from fixed bonds for the first time since 2008. And square metre values have risen in all major cities. Stronger demand will only push these higher as more Brazilian buyers seek to take advantage of record low interest rates.

That makes now an optimum time to invest in this exciting market. BRIC Group have several investment options at The Coral, its 5-star award-winning resort in Ceará. Buy-to-let returns are particularly attractive at the resort where turnkey villas have a projected return of 11.7% a year. Apartments come with guaranteed returns (6% or 7%) over 2 or 3 years.

And with the Brazilian Real currently cheap on the world’s currency markets, investment at The Coral costs you less. Find out more about how to get the most out of the Ceará property market.

(Source: Diario do Nordeste)