Global property investment increased in 2015. As this BRIC Group article reports, prices saw a rise of 3 per cent last year as savvy investors made the most of low interest rates and the opportunities available across the globe.

The latest Knight Frank Global House Price Index shows that property prices in the 55 countries within the Index went up by 3 per cent during 2015. This increase is considerably higher than the 2.3 per cent registered in 2014. The bullish attitude in property investment – 43 nations registered price increases – comes despite the general economic uncertainty seen last year and is bolstered by low interest rates in many countries.

Property in Turkey and New Zealand best performances

Prices rises for property in Turkey top the list both for the entire year and for Q4. House prices went up by 18 per cent over the year and by 3.6 per cent in the three months between October and December. Knight Frank attributes this to the preference among Middle Eastern buyers who favour Turkey for property investment.

In second place lies property in New Zealand where prices went up 14.2 per cent over the year. Other strong performers during 2015 were Swedish property – the increase reached 12.3 per cent, Australia where the rise exceeded 10 per cent and Luxembourg with a 9.2 per cent uptick.

Top regions

Boosted by the price hikes in Australia and New Zealand, Australasia ranks as the top performing region. In this part of the world, prices rose by 12.4 per cent during 2015. This figure almost doubles the second best region, the Middle East where prices rose by 6.7 per cent, and clearly illustrates the buoyant market for Australian property.

The two American continents both registered increases in property prices of 4.6 per cent last year while those in Europe went up by 3.7 per cent. The only global region to show a decrease was Russia-CIS where house prices dropped by 6.2 per cent, an indication that the Russian property market still lies in recession.

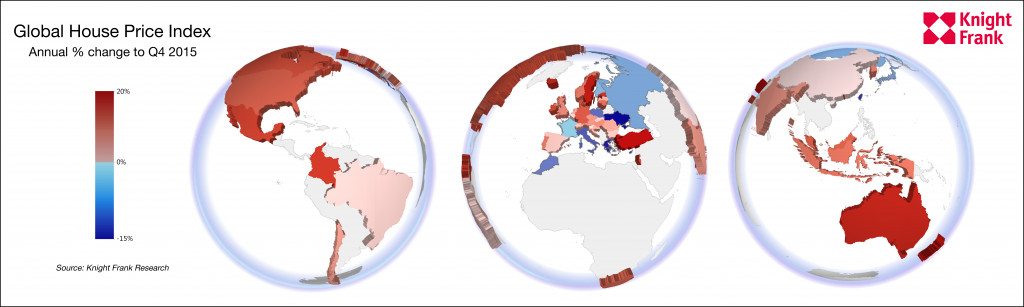

The differences in global property markets can be clearly seen in the continental graphic compiled by Knight Frank. Australasia and the Americas dominate the red-pink tones while Europe combines a mixture of hot red and very cold blue.

Poor quarterly performers

At the other end of the scale lie Hong Kong, Slovenia and Finland. In the last quarter of 2015, Hong Kong property prices fell by 3.7 per cent. This figure contrasts hugely with the annual figure (up 7.1 per cent) and reflects the change in dynamics within the Hong Kong property market. According to Knight Frank, the supply of property on the island increased by over 11,200 units last year and this added to an expected rise in interest rates led to a slow-down in market conditions.

Several European economies also saw house price drops during Q4 last year. These included Slovenia with a decrease of 2.8 per cent and Finland where property prices fell by 2.9 per cent over the three months.

Over the year, the worst performers were also European. Ukraine topped the rankings with a 12 per cent plummet in property prices, followed by Greece where house prices dropped by a 5 per cent.

Despite the increase in property prices during 2015 overall, Knight Frank says their outlook for this year is “muted”. According to the author of the Index Kate Everett-Allen, the overall rate of growth will “be weaker in 2016 than 2015” because of low oil prices, the strong dollar and slower economic growth in China.

For BRIC Group, the Index highlights the importance of researching individual markets for investment as performance can vary widely. “The situation in the US is a particular highlight in this research, showing the Americas as having good potential for property investment” says Dies Poppeliers, Managing Director. “Not only did property prices rise by 5.2 per cent in the year, the market direction is, according to Knight Frank, on the up.”

An investment company specialising in global real estate opportunities, BRIC Group is currently developing The Coral resort, in Northeast Brazil, a luxury beachfront resort. BRIC Group also offers US real estate investments including turnkey properties in Florida and Houston, and land plots in Florida. BRIC Group has been creating wealth for its clients since 1996 and has offices in Brazil, Dubai (consulting office), Hungary, Spain and the US.

Source: Knight Frank